How to Calculate Pro Rata Salary UK Complete Guide 2026

If you work part-time in the UK, or you are starting a new job mid-year, understanding how to calculate your pro rata salary is very important. Pro rata salary calculation helps you find out exactly how much you should earn based on your hours or days worked compared to a full-time employee.

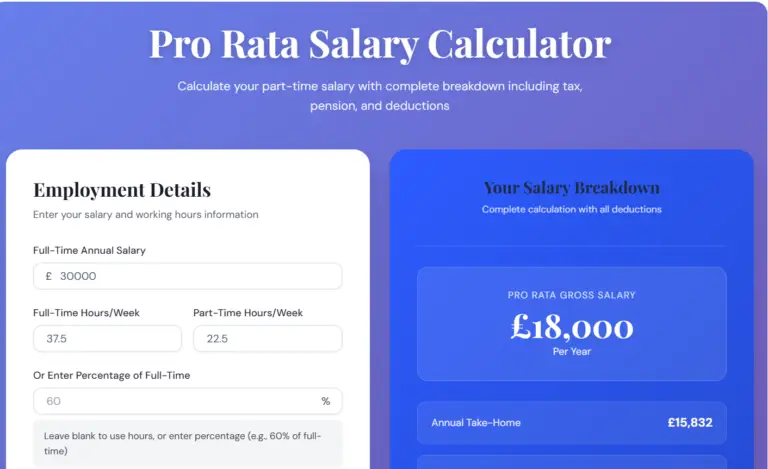

In this complete guide, you will learn what pro rata means, how to calculate it step by step, and how to use our free Pro Rata Salary Calculator UK to get your answer in seconds.

What Does Pro Rata Mean?

The term pro rata comes from Latin and means “in proportion.” In the UK workplace, pro rata salary means that a part-time employee’s salary is calculated in proportion to a full-time employee’s salary. For example, if a full-time job pays £40,000 per year for 40 hours per week, and you work 20 hours per week, your pro rata salary would be £20,000 per year.

Pro Rata Salary Formula How to Calculate It

The basic pro rata salary formula is:

Pro Rata Salary = (Full-Time Salary ÷ Full-Time Hours) × Your Hours

You can also calculate it by days:

Pro Rata Salary = (Full-Time Salary ÷ Full-Time Days) × Your Days

Step-by-Step Pro Rata Salary Calculation

Examples

Example 1: Part-Time Hours Calculation

Situation: Full-time salary is £36,000/year for 37.5 hours/week. You work 25 hours/week.

- Divide full salary by full hours: £36,000 ÷ 37.5 = £960

- Multiply by your hours: £960 × 25 = £24,000 per year

- Your pro rata salary = £24,000 per year

Example 2: Part-Time Days Calculation

Situation: Full-time salary is £30,000/year for 5 days/week. You work 3 days/week.

- Divide full salary by full days: £30,000 ÷ 5 = £6,000

- Multiply by your days: £6,000 × 3 = £18,000 per year

- Your pro rata salary = £18,000 per year

Example 3: What is £28,000 Pro Rata?

Many people search for “what is 28000 pro rata” online. Here is the answer:

If the full-time salary is £28,000 for 37.5 hours/week and you work 20 hours/week:

£28,000 ÷ 37.5 × 20 = £14,933 per year

Do not want to calculate manually? Use our Free Pro Rata Salary Calculator UK just enter your numbers and get instant results.

How to Calculate Pro Rata Take Home Pay (After Tax)

Your pro rata salary is your gross salary before tax. To calculate your pro rata take home pay after tax in the UK, you need to consider Income Tax and National Insurance deductions.

UK Tax Bands 2026:

- Personal Allowance: Up to £12,570 — 0% tax

- Basic Rate: £12,571 to £50,270 — 20% tax

- Higher Rate: £50,271 to £125,140 — 40% tax

- Additional Rate: Above £125,140 — 45% tax

Our Pro Rata Salary Calculator automatically calculates your take home pay after tax and National Insurance so you do not have to do this manually.

Pro Rata Salary vs Annual Salary Key Differences

- Annual Salary: The full salary paid to a full-time employee working all year

- Pro Rata Salary: A proportion of the annual salary based on actual hours or days worked

- Pro Rata Holiday: Holiday entitlement calculated proportionally for part-time workers

Pro Rata Holiday Entitlement How to Calculate

In the UK, full-time employees are entitled to a minimum of 28 days paid holiday per year including bank holidays. Part-time employees receive a pro rata proportion of this.

Pro Rata Holiday = (Your Days Per Week ÷ 5) × 28 Days

Example: If you work 3 days per week: (3 ÷ 5) × 28 = 16.8 days holiday per year

Common Pro Rata Salary Questions

How to Work Out Pro Rata Hours?

To work out pro rata hours, divide your actual hours by the full-time hours, then multiply by the full-time salary. For example: if full time is 37.5 hours and you work 30 hours, your pro rata fraction is 30/37.5 = 0.8 or 80% of full-time salary.

How to Calculate Pro Rata Salary UK Gov?

The UK government follows the same proportional calculation method. Your employer must pay you a fair pro rata proportion of the advertised full-time salary. Always check your employment contract for the full-time equivalent (FTE) salary.

What is Pro Rata School Salary?

School staff in the UK often work term-time only (around 39 weeks per year). Their salary is calculated pro rata based on term-time weeks divided by 52 weeks in a year.

Also See Other Free Calculators

You might also find these free tools helpful:

- Discount Calculator — Calculate sale prices and percentage discounts instantly

- Poisson Distribution Calculator — Calculate probability with step-by-step solutions

- Numerology Calculator — Calculate your life path and master numbers free

Conclusion

Calculating your pro rata salary does not have to be complicated. Whether you are a part-time worker, starting a new job mid-year, or working term-time only, the formula is simple: divide by full-time hours and multiply by your hours.

Save time and avoid errors by using our Free Pro Rata Salary Calculator UK which instantly calculates your gross and net take home pay including tax and National Insurance deductions.